Menu

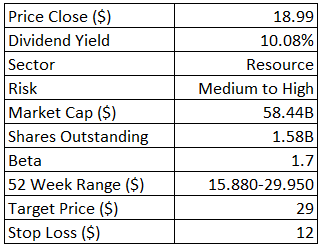

Fortescue Ltd. engages in the development of iron ore deposits. It operates through the Metals and Energy segments. The Metals segment includes exploration, development, production, processing, sale, and transportation of iron ore, and the exploration for other minerals. The Energy segment is involved in the development of green electricity, green hydrogen, and green ammonia projects. The company was founded by John Andrew Henry Forrest in April 2003 and is headquartered in East Perth, Australia.

(Source: TradingView) One-Year Performance Profile of FMG compared to ASX 200.

Fortescue Limited (ASX: FMG) has recently released its annual financial results for the fiscal year 2024, concluding on 30 June 2024.

The company reported a robust operational performance, highlighted by iron ore shipments totaling 191.6 million tonnes (Mt), which resulted in the third highest earnings in its history.

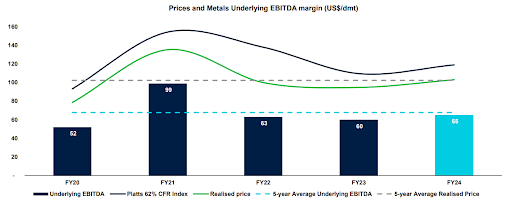

The underlying EBITDA reached US$10.7 billion, reflecting a seven percent increase compared to FY23, and an underlying EBITDA margin of 59 percent.

The net profit after tax (NPAT) stood at US$5.7 billion, translating to earnings per share of US$1.85 (A$2.82).

Additionally, net cash flow from operating activities was recorded at US$7.9 billion, with free cash flow amounting to US$5.1 billion after capital expenditures of US$2.9 billion.

The company declared a fully franked final dividend of $0.89 per share, bringing the total dividends for FY24 to $1.97 per share, which corresponds to $6.1 billion and represents a 70 percent payout of NPAT.

As of 30 June 2024, Fortescue maintained a strong balance sheet, with cash reserves of US$4.9 billion and net debt of US$0.5 billion.

(Graphic Source: TradingView)

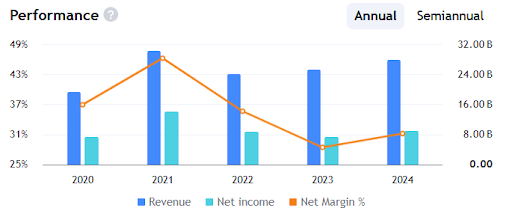

Over the past five years, Fortescue has experienced fluctuating financial performances. Following record-high revenues of $29.8 billion and earnings of $13.8 billion in 2021, the company saw declines, with 2022 revenues dropping to $23.9 billion and earnings to $8.55 billion. This trend continued into 2023, where earnings fell further to $7.13 billion. However, Fortescue rebounded in 2024, with revenues climbing back to $27 billion and earnings slightly improving to $8.67 billion. These shifts underscore the company’s exposure to market cycles and operational adaptability, demonstrating resilience in challenging periods and swift recovery potential.

(Graphic Source: TradingView)

Fortescue has demonstrated a strong commitment to shareholder returns through its dividend policy, showing a steady upward trend despite earnings fluctuations. From a dividend of $1.14 per share in 2019, the payout rose to $1.97 in 2024, peaking impressively at $3.58 in 2021. The company’s dividend yield has remained attractive, now standing at 10.08%, which is expected to hold steady near these levels. Fortescue’s consistent distributions, even during periods of lower earnings, underscore its dedication to delivering value to shareholders and highlight its capability to support robust dividend yields over the long term.

(Graphic Source: Company Reports)

Fortescue presents a compelling investment thesis rooted in its strong capital management, stable margins, and effective hedging strategies, which have shielded it from major market downturns. This disciplined approach enhances the company’s resilience and positions it well for sustainable earnings and dividend growth. As global infrastructure demands and urbanization stand to drive long-term iron price improvements, Fortescue’s prospects remain robust. Additionally, the company’s strategic expansion plans signal a forward-looking growth trajectory, suggesting further value creation for shareholders.

Fortescue’s outlook appears promising, with substantial growth and sustainability initiatives underway. The recent commencement of the Green Metal Project in August 2024 demonstrates significant progress in the company’s expansion efforts, positioning it to meet rising demand for green metals. Additionally, Fortescue’s commitment to renewable energy is evident through its ambitious plan to establish a 1GW solar infrastructure project by the decade’s end. These strategic moves not only enhance Fortescue’s production capacity but also align with global sustainability trends, potentially offering long-term benefits and competitive positioning in an increasingly green-focused market.

Fortescue’s future scalability prospects are highly promising, particularly when combined with its strong resilience in operational efficiency and stable margins. This synergy signals attractive potential for significant earnings breakthroughs in the coming years. The company’s robust distribution rates, coupled with high double-digit yields, underscore its capacity for consistent income generation for investors over the long term. Furthermore, Fortescue’s current valuation is appealing, with a price-to-earnings (P/E) ratio of just 7.07x, representing a considerable discount compared to historical levels. This combination of scalability, income potential, and attractive valuations positions Fortescue as a compelling investment opportunity.

As per Pristine Gaze, you may consider a “Buy” on “Fortescue Limited” at the closing price of “$18.99” (As of 25 October 2024).

*All currency figures are in Australian Dollars unless stated otherwise.

*All data sourced from Company Reports and TradingView.

The reports provided by Pristine Gaze are designed to deliver comprehensive stock and sector analysis, market insights, and investment recommendations, drawing upon our research and expertise. However, it is important to note that these reports are intended for informational purposes only and do not constitute personalised financial advice. They do not consider your individual investment objectives, financial situation, or specific needs.

Before making any investment decisions based on the insights and recommendations included in these reports, we strongly advise consulting with a qualified financial advisor who can provide tailored advice that aligns with your personal circumstances.

Pristine Gaze, including its directors, employees, associates, and affiliates, assumes no liability for any loss or damage incurred as a result of relying on the information or recommendations provided in these reports. This encompasses, but is not limited to, direct, indirect, incidental, or consequential losses.

While we endeavour to ensure the accuracy and timeliness of the information presented in our reports, we cannot guarantee its completeness or accuracy, and the content may change without prior notice. The inclusion of any stock or sector within these reports does not serve as an endorsement or recommendation, and such mentions may be altered or removed at any time.

These reports may reference external data or links to third-party resources, for which Pristine Gaze takes no responsibility. The use of such information or resources is at your own risk.

All content within the Pristine Gaze reports, including but not limited to text, graphics, and analysis, is the intellectual property of Pristine Gaze and is protected under applicable copyright and trademark laws. Unauthorised use or distribution of this content without prior consent is prohibited.

By accessing or utilising Pristine Gaze’s reports, you acknowledge and agree to the terms outlined in this disclaimer. For further details, please refer to our full Terms and Conditions and Privacy Policy.

Your trusted partner in navigating the complexities of investment markets. Unbiased Research, Expert Analysis, and Clear Coverage for Financial Freedom. Start Your Journey Today!

Disclaimer: Pristine Gaze Pty Ltd trading as Pristine Gaze (ABN 66 680 815 678) is a Corporate Authorised Representative (CAR No. 001312049) of Alpha Securities Pty Ltd (AFSL 330757). The information provided is general information only. Any advice is general advice only. No consideration has been given or will be given to individual objectives, financial situation, or specific needs of any particular person or organisation. The decision to engage our services and the method selected is a personal decision and involves inherent risks, and you must undertake your own investigations and obtain independent advice regarding suitability for your circumstances. Past performance, examples, or projections are not indicative of future results. While we strive to provide accurate information, we make no guarantees regarding the accuracy or completeness of our materials.

Disclaimer: Pristine Gaze Research Inc. (EIN: 320779455) is registered in Delaware. All information provided on the website is for general knowledge and educational purposes only and does not constitute personalized investment advice. Pristine Gaze offers stock analysis, market insights, and investment newsletters, but this content does not consider individual financial needs. Investment is related to market risk please do your due diligence before investing. Please Seek independent financial advice before making decisions. Due diligence is not a luxury, it is a basic need. Pristine Gaze is not liable for any loss from the use of its content, which may change without notice as it is sourced from public domain. Do read our Refund Policy, Terms and Conditions and Privacy Policy.